Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

Important

Some of the functionality described in this release plan has not been released. Delivery timelines may change and projected functionality may not be released (see Microsoft policy). Learn more: What's new and planned

| Enabled for | Public preview | General availability |

|---|---|---|

| Users, automatically | Oct 2025 | Nov 2025 |

Business value

Save time and reduce costs when you submit IRS 1099 forms electronically through the IRIS platform directly from Business Central.

Feature details

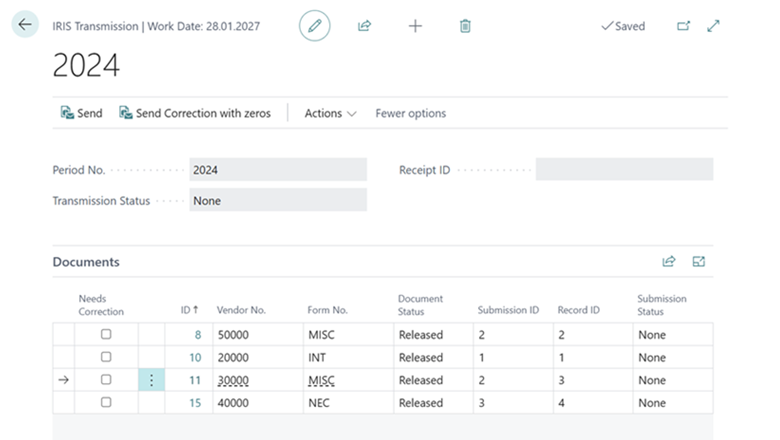

Microsoft announced new IRS 1099 reporting features in the 2024 release wave 1. Now, we're providing extra features for 1099 form submissions through API integrations. When you integrate with the IRIS platform, you can submit IRS 1099 forms electronically. This integration saves you a lot of time and reduces costs. It removes the need for manual data entry and lowers the administrative burden. With this integration, you can focus more on other important business activities. The integration with the IRIS platform makes the whole filing process simpler. It keeps accuracy and compliance with IRS regulations. You can track the status of your submissions by using the IRIS Transmission page.

When you use this feature, you can efficiently manage your tax reporting obligations right within Business Central. You boost productivity and lower the risk of errors or delays. This capability is especially valuable for businesses that want to optimize operational efficiency and keep compliance with tax authorities.

Note

This feature is available only for Business Central online.

Geographic areas

Visit the Explore Feature Geography report for Microsoft Azure areas where this feature is planned or available.

Language availability

Visit the Explore Feature Language report for information on this feature's availability.

Tell us what you think

Help us improve Dynamics 365 Business Central by discussing ideas, providing suggestions, and giving feedback. Use the forum at https://aka.ms/bcideas.